how to pay indiana state withholding tax

December 20 2017. That means no matter how much you make youre taxed at the same rate.

22 Printable Indiana Tax Forms Templates Fillable Samples In Pdf Word To Download Pdffiller

INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state.

. You are still liable for any additional taxes due at the end of the tax year. Find Indiana tax forms. Businesses can close their tax accounts on INTIMEIf a business does not have an INTIME account then it is required to send an Indiana Tax Closure Request Form BC-100If the tax.

Formerly many Indiana withholding tax payers could pay on paper. INtax supports the following tax types. Up to 25 cash back Here are the basic rules on Indiana state income tax withholding for employees.

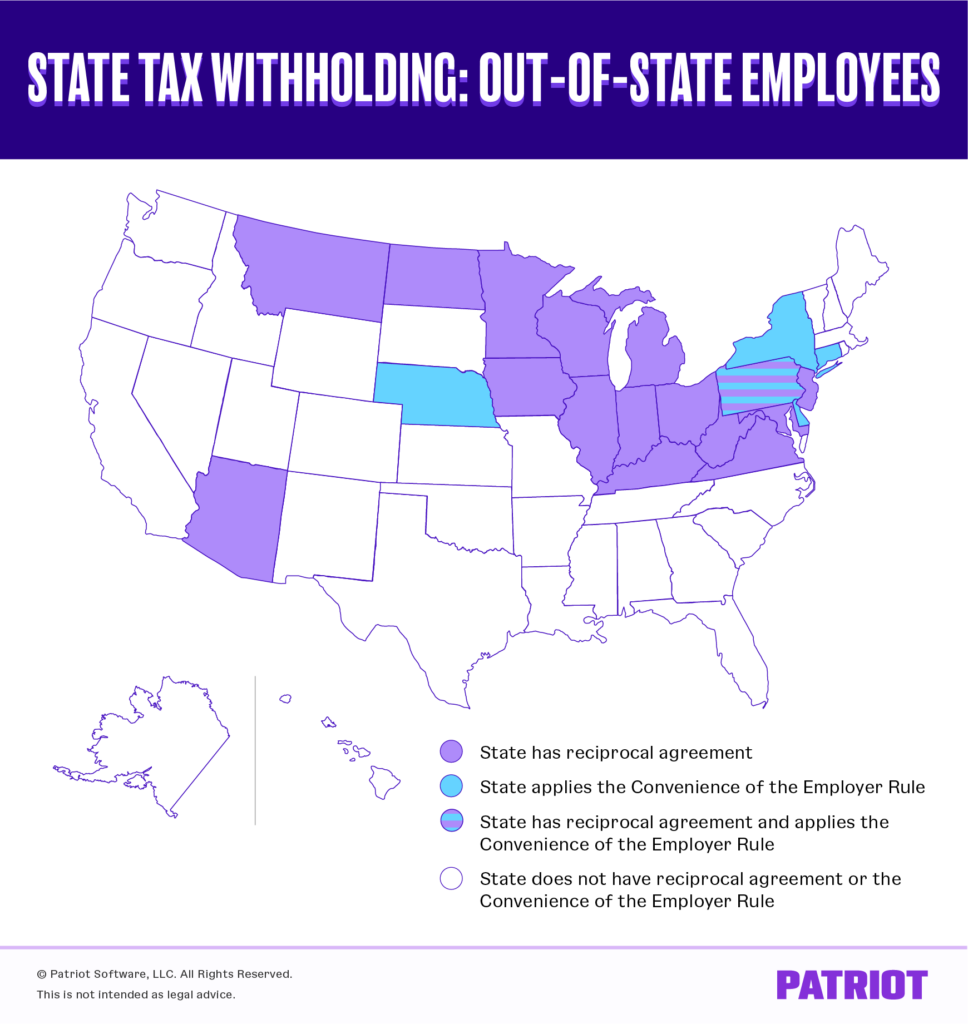

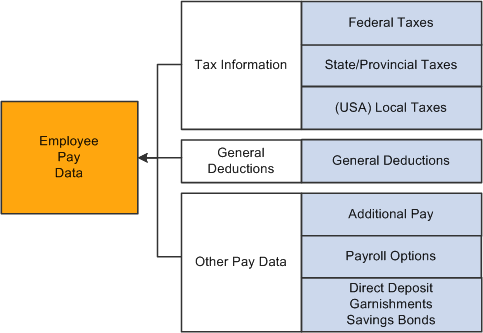

Indiana county resident and nonresident income tax rates are available via Department Notice 1. There are income restrictions if you or your spouse has a retirement plan through your employer. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes.

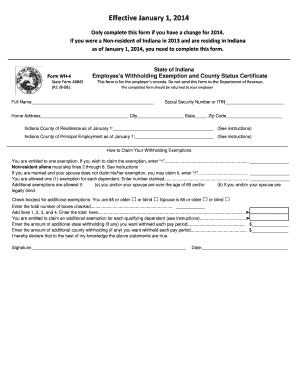

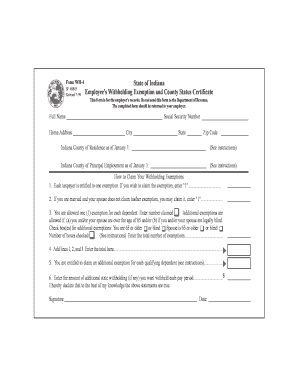

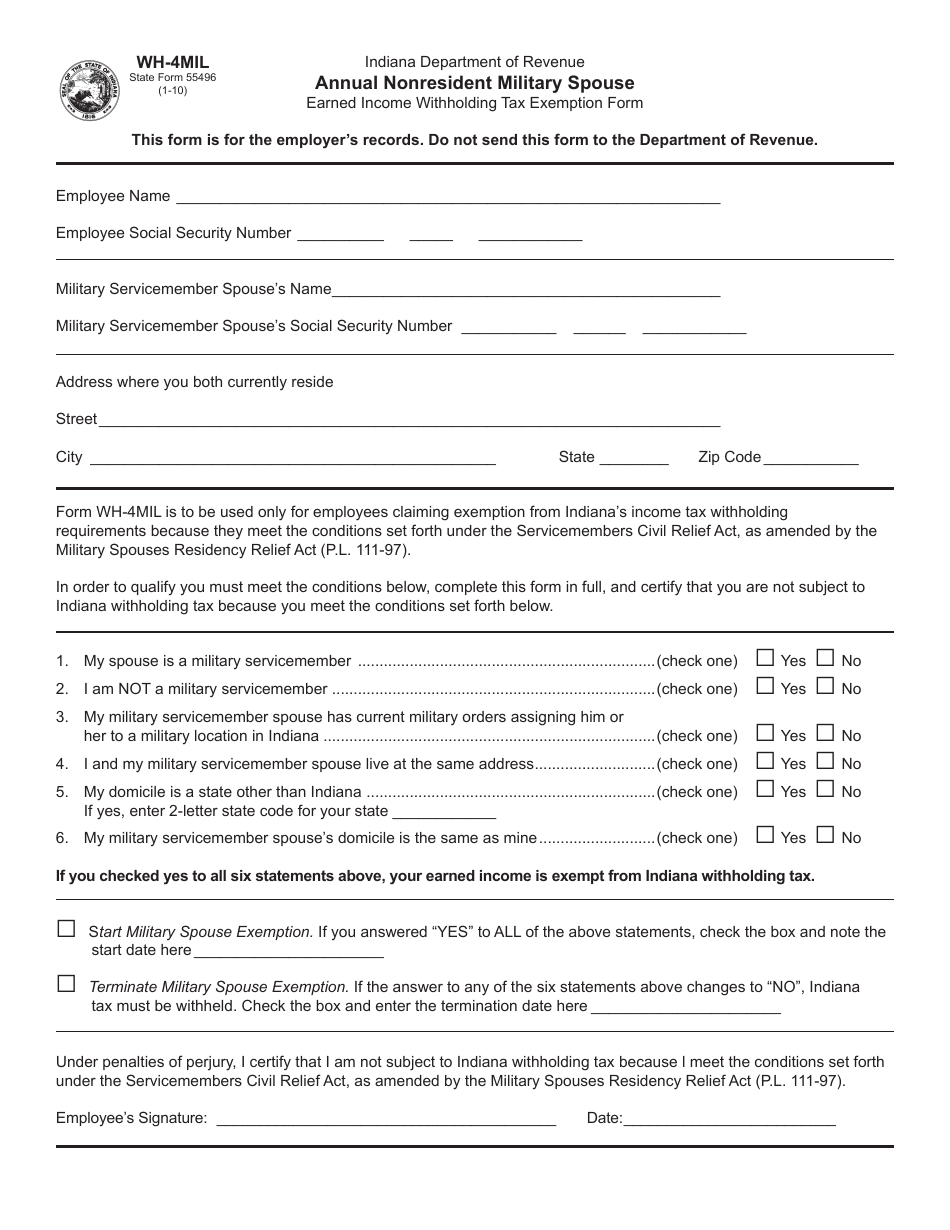

Employees Withholding Exemption County Status Certificate. Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form. What are the payroll tax filing requirements.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. For Medicare tax withhold. Indiana State Withholding Form.

Residents of Indiana are taxed at a flat state income rate of 323. Does not obligate your employer to withhold the amount. Form WH-1 Withholding Tax Voucher for EFT Early Filer.

A withholding agent who fails to withhold and pay to the Department any money required to be withheld and paid is personally individually and corporately liable to the State of Iowa. For single or head of household status the limit is 56000 for a full. INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more.

Both the county of residence and the county of. Find Indiana tax forms. County Rates Available Online.

Forms required to be filed for Indiana payroll are. For the feds. Each and every year all staff members are required to file their state Withholding Tax Develop using the IRS.

Employer Guidance On How To Compute Payroll Withholding For Indiana State And County Income Tax. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. All counties in Indiana impose their own local.

Know when I will receive my tax refund. All businesses in Indiana must file and pay their sales and. It has created the New and Small Business.

Know when I will receive my tax refund. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. If the employer does withhold the ad-ditional amount it.

Indiana businesses have to pay taxes at the state and federal levels.

Solved Brent Is A Full Time Exempt Employee In Clark County Chegg Com

Indiana County Income Taxes Accupay Tax And Payroll Services

Indiana Tax Calculator Internal Revenue Code Simplified

County Income Tax Porter County In Official Website

Dor Unemployment Compensation State Taxes

Form W 2 Boxes Office Of The University Controller

Indiana W4 Fill Out And Sign Printable Pdf Template Signnow

State Tax Withholding For Remote Employees

Peoplesoft Payroll For North America 9 1 Peoplebook

Indiana State Withholding Tax Setup Youtube

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Change Employee Tax Information Human Resources Purdue University

How To Do Payroll In Indiana What Every Employer Needs To Know

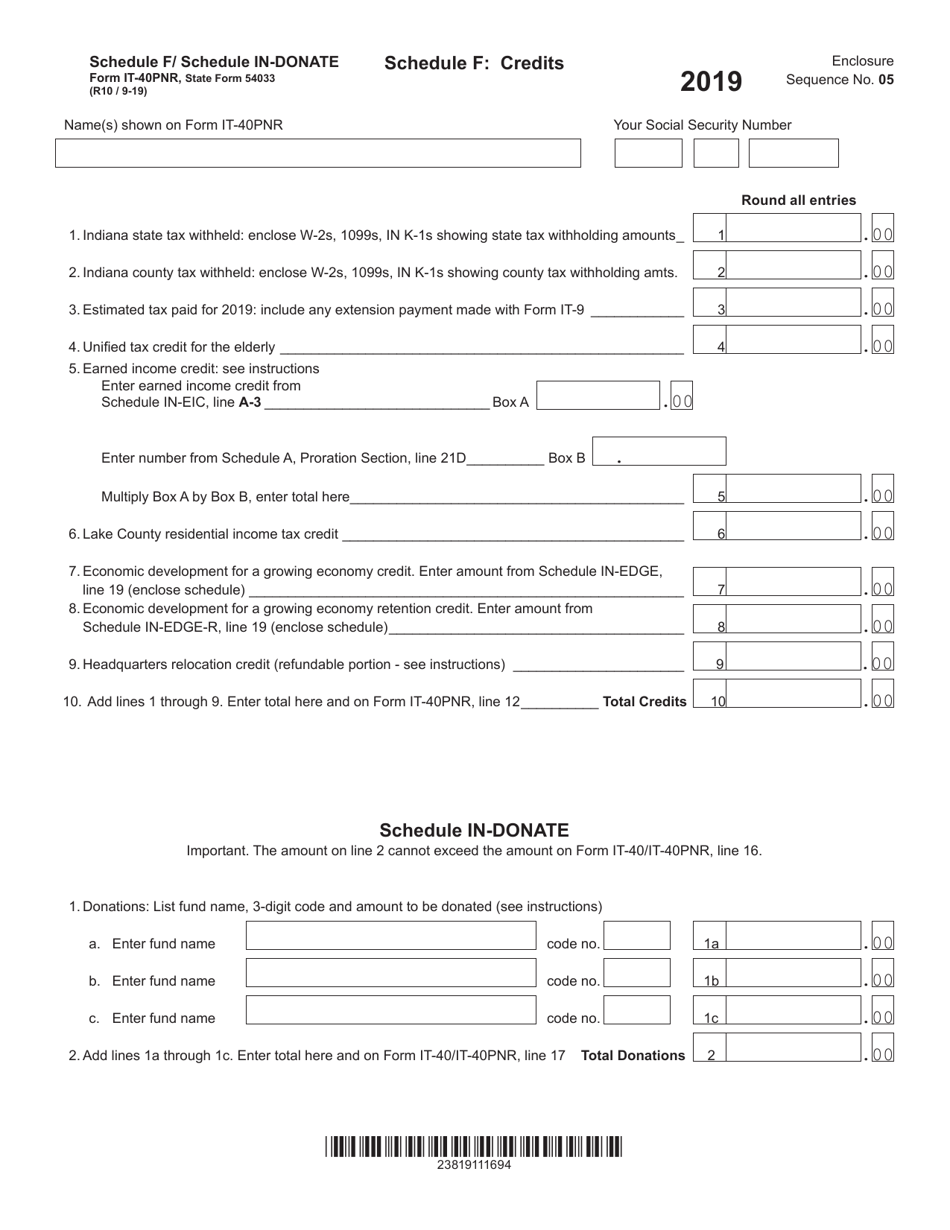

Form It 40pnr State Form 54033 Schedule F In Donate Download Fillable Pdf Or Fill Online Credits Donations 2019 Indiana Templateroller

Indiana W4 Printable Fill Online Printable Fillable Blank Pdffiller

State Form 55496 Wh 4mil Download Fillable Pdf Or Fill Online Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form Indiana Templateroller

Annuitants Request For State Income Tax Withholding Wh 4p Indiana